Go through the fine print. Be sure to are mindful of all the details in the loan settlement before signing around the dotted line.

MoneyLion offers a range of financial services, such as an investment decision account and credit rating builder software Together with its cash progress assistance, which could attract folks planning to household many products and services under a single roof.

Not precisely. DailyPay and Payactiv are A part of the earned wage entry field, that means they function with your employer for making element of the paycheck readily available just before payday.

On the other hand, this doesn't influence our evaluations. Our views are our individual. Here is a list of our partners and This is how we earn money.

But some client advocates take into account them thinly veiled payday lenders, given that equally offer tiny-greenback loans due with your future payday.

Online lenders also provide undesirable-credit score borrowers and will fund loans the following business day, but rates may very well be better.

Most apps cap your initial progress at $a hundred or much less, and could improve your Restrict when you establish a history of on-time repayments.

She notes The brand new breed of fintech payroll lenders may possibly appear to be harmless, click here but They are really “for-income, moneymaking ventures” that aren’t giving the developments out on the goodness of their hearts.

Kiah Treece is a little enterprise owner and private finance pro with expertise in loans, company and private finance, insurance policy and real estate.

Also examine on line reviews to determine how past and existing borrowers truly feel with regards to the lender’s software procedure, acceptance odds and purchaser aid. This will let you look for a lender that is reputable and trustworthy.

Klover will make dollars by amassing mixture user facts and sharing insights with its companions, so if you’re worried about information privateness, Klover will not be for you.

Get now, pay back later: “Get now, pay back later” apps like Affirm and Afterpay break up a large purchase, just like a mattress or laptop computer, into smaller payments. The most common framework is definitely the pay-in-four prepare, in which you spend 25% on the expenditure upfront and then make a few far more biweekly payments.

Particular loans guideGetting a personal loanLoans for terrible creditManaging a private loanPersonal loan reviewsCompare major lendersPre-qualify for a personal loanPersonal loan calculator

Look at our household purchasing hubGet pre-permitted to get a mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs get calculatorHow A lot am i able to borrow mortgage calculatorInspections and appraisalsMortgage lender evaluations

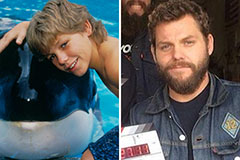

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now!